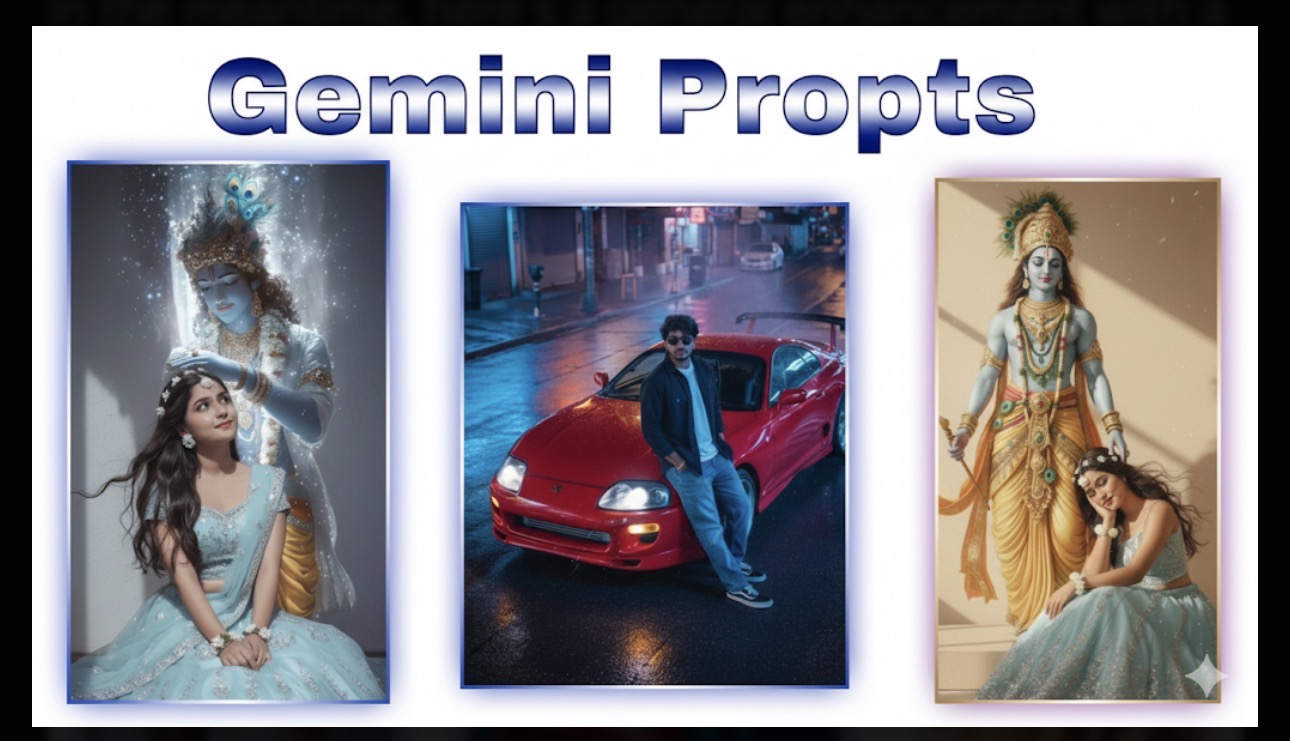

Google Gemini has become a go-to tool for transforming ordinary photos into extraordinary works of art. Its AI-powered image editing capabilities, often referred to as “Nano Banana,” allow users to manipulate images with simple text prompts. Instead of complex software, you just need a clear idea.

Top Prompts to Try:

- “Turn this photo into a cinematic movie poster, with dynamic lighting and vibrant colors.” This is great for giving your pictures a professional, dramatic feel.

- “Recreate this person as a 1950s Hollywood movie star, with retro makeup and a glamorous red carpet backdrop.” Perfect for a vintage, sophisticated look.

- “Transform this image into a photorealistic 3D figurine, placed on a desk with a collectible display base.”This prompt is a creative way to turn a portrait into a unique digital collectible.

To get the best results, you need to be descriptive and specific. Mention the style, lighting, setting, and even the camera type to get the look you want. While there isn’t an official “prompts PDF” from Google, many websites and tech blogs compile and share these creative prompts for you to download and try. Just search for “Google Gemini image editing prompts PDF download” to find a variety of resources.

Preparing Your Link…

Click the button below to unlock prompts.

Best Loan Apps in India & How to Apply for a Credit Card 🏦💳

India’s financial technology (FinTech) sector has made accessing credit easier than ever. Instant loan apps and online credit card applications have streamlined the borrowing process, making it paperless and quick.

Best Loan Apps in India

For instant personal loans, several apps have gained popularity due to their user-friendly interfaces and rapid disbursal.Some of the best loan apps in India include:

- KreditBee: Known for its small, flexible loans with quick approval and disbursal. It’s a great option for young professionals.

- Moneyview: Offers loans up to ₹10 lakh with competitive interest rates and a simple, paperless process. Funds are often disbursed within 24 hours.

- Navi: This app provides personal loans and home loans with a completely digital process, from application to disbursal, making it hassle-free.

- CASHe: Caters specifically to salaried individuals, offering instant loans with a simple application and a transparent process.

These apps require minimal documentation, often just your PAN and Aadhaar card, and can disburse funds in minutes or a few hours.

How to Apply for a Credit Card Online

Applying for a credit card has also become a simple, digital process. The steps are generally consistent across most banks and financial institutions in India.

Steps to Apply:

- Check Eligibility: Visit the bank’s website or use a financial aggregator site to check your eligibility based on your income, age, and credit score.

- Choose a Card: Select a card that aligns with your spending habits and offers the best rewards, cash back, or travel benefits.

- Fill the Application: Complete the online application form with your personal and financial details.

- Upload Documents: Upload scanned copies of required documents, such as your PAN card, Aadhaar card, and proof of income (salary slips or bank statements).

- E-KYC and Verification: Complete the digital KYC process, which may involve a video call or OTP-based verification.

Many banks now offer pre-approved credit cards to existing customers, making the process even faster. The key is to maintain a good credit score and choose a card that fits your financial lifestyle.